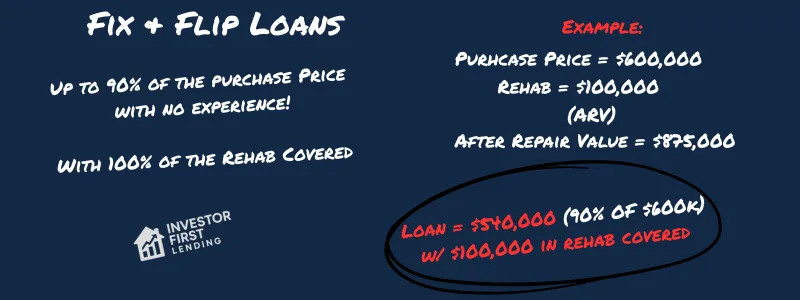

The Basics of a Fix & Flip Loan

With a fix & flip loan you can get a loan for up to 90% of the purchase with 100% of the rehab covered.

This means if you were buying a property for $200,000 that needed $50,000 of work and the ARV (after-repair-value) was $350,000 you could get a loan for $180,000 to buy the property (90% of the $200k purchase price) and the rehab ($50,000) would be covered as part of the loan.

It's important to note that rehab ($50,000 in this example) is done on a draw basis.

This means when you close on the property you'll need some money to start rehab because unforutnately the lender isn't just going to hand you $50,000. -- (It's done this way to prevent fraud -- If a person put $20k down to buy the property + closing costs but got $50k in cash at closing they just made $30k (minus closing costs) and could run off with the money.)

You'll do some work (example $10,000), let the lender know the work is done, they'll verify it's done and then they'll wire you the $10,000 (usually minus the cost of inspecting fee which is usually around $200).

A typical term on a fix & flip loan is 6 to 24 months. -- (remember, this is a short term loan where you're going to fix up the property and sell it or refinance it, pull your investment back out and go on to your next property)

Cons of Fix & Flip Loans

They're not cheap.

Fix and flip loans usually include a charge of 2 to 4 points (a point is 1% of the loan amount) and interest rates are usually between 9 & 13%.

Pros of Fix & Flip Loans

You can acquire a property with as little as 10% of your own money (+ closing costs) with 100% of the rehab covered.

You can acquire a property that would not qualify for coventional finanacing.

It is not a full doc loan meaning you do not need to provide your personal income or employment information to qualify.

While the interest rate and points are higher you'll only have the loan for a short period of time. For example: If you buy a property that you rehab & refinance (or sell) in 90 days you might only make 2 payments on the fix & flip loan

Because you can buy a property with as little as 10% of your own money you have any additional money available in the event you run across another great deal you want to take advantage of. Example: You use your entire savings to buy a property and you start rehabbing the property. 2 weeks after you close you run across another great deal but you can't take advantage of it because you've used your entire savings to buy the first property. If you had used a fix & flip loan you could have acquired the first property with as little as 10% down and then used another fix & flip loan to acquire the second property.

You won't destroy your credit as long as you make your monthly payments on time on a fix & flip loan. But, I've seen countless examples of investors using their credit cards to finance flip projects and too often they max out their credit cards. When this happens their credit score drops significantly which leaves them in a very tough spot. If an investor wants to keep the property once the rehab is complete they'll often refinance into a DSCR loan but if they've ruined their credit because they maxed out (or used more than 30% of the available balance) their credit cards their credit score will usually drop significantly and it becomes very difficult to refinance into a DSCR loan. They can still sell the property and payoff or pay down their credit cards which will eventually result in their credit score going back up, but this can sometimes takes months. If they run across a great deal on a property this may result in them missing out on it because of their low credit score.

The bottom line is that fix & flip loans are an excellent tool if you factor in the closing costs and the monthly payments in your overall analysis and the deal still makes sense.

Please select state(s) below where you have invested or are interested in investing. We provide tips, tricks & tools specific to the markets you're investing in to help you save and make more money.

The Investor Starter Kit Includes:

✅Credit Boost Blueprint -- simple tips to start improving your credit right now

✅DSCR Blueprint -- one-page cheat sheet to help you get approved

✅DSCR Calculator -- find out fast if a property cashflows

✅Fix & Flip Checklist -- step-by-step guide to help you get approved

✅Fix & Flip Calculator -- run numbers on a property to see if it's likely to qualify

👍👍👍👍Get UNLIMITED AVM's and Property Rental Reports on Demand!

Have a property and you're curious about what it might appraise for or rent for?

Just let us know and we'll do the research and send you a 8+ page report for free!

Consumer Complaint Info

Texas Complaint/Recovery Fund

Figure: 7 TAC §80.200(b)